Vancouver, BC – November 21, 2024 – Etruscus Resources Corp. (CSE: ETR) (OTC: ETRUF) (FSE:ERR) (the “Company” or “Etruscus”) is pleased to announce initial results from its 2024 exploration program (the “Program”) at the Company’s Rock & Roll Property located in the prolific Golden Triangle in Northwestern British Columbia, Canada. The Program included rock sampling, geological mapping, Terraspec data collection, and a 6 line-kilometer induced polarization (IP) survey. Analysis of the IP survey and mapping data at the Zappa porphyry target has encouraged the team to plan a comprehensive drilling program for the summer of 2025. Additionally, results from the Pheno claims have identified a new kilometer-scale rare earth element (REE) prospect in the early stages of discovery.

Stephen Wetherup, Etruscus’ VP of Exploration, commented, “We are encouraged by the results from the 2024 exploration program. Reconnaissance rock sampling on the Pheno claims has revealed exotic geology and provided promising assays, highlighting the potential of this large-scale REE discovery. We look forward to further enhancing the value of this new claim package as exploration advances in 2025. At the Zappa target, we were unable to drill due to last minute logistical challenges, so we were able to complete a number of other surveys, and this has given us better confidence to locate drill targets in 2025. We now have everything we need to test this target, with the goal of identifying the next major copper-gold porphyry deposit in the Golden Triangle.”

Program Highlights

- Geological mapping confirms significant QSP alteration above Zappa chargeability anomaly, adjacent to receding glacier;

- TerraSpec® short wave infrared analysis (SWIR) confirmed high temperature clay minerals at surface over the Zappa anomaly, further validating the target’s porphyry potential;

- Initial IP pseudo sections over the Zappa provide encouraging results (inversions and interpretation pending);

- Pheno claims demonstrate large scale REE geochemical anomaly hosted in peralkaline rhyolites; and

- High grade gold float returned; Kashmir target (23.8 g/t Au), Heather target (40.1 g/t Au).

Discovery/Zappa

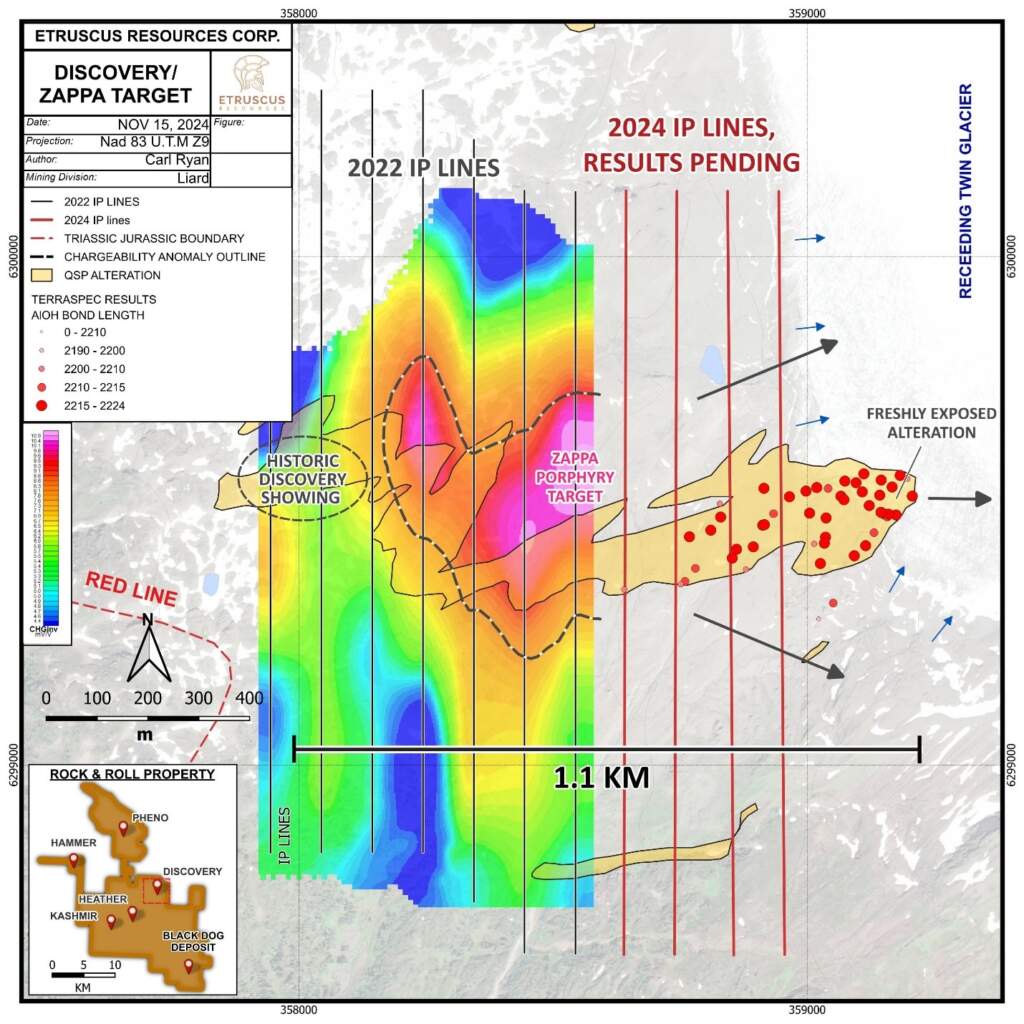

The 2024 field program was focused on the Discovery area and the adjacent Zappa chargeability anomaly. This zone represents a sizeable copper-gold porphyry target with 1.1 km of QSP alteration mapped at surface and a discrete, open-ended chargeability anomaly residing below. This target is located at the geologically important “Red-Line” unconformity and has never been drilled.

During the 2024 field program, geological mapping, rock samples, and Terraspec SWIR analysis were completed primarily to the east of the historic Discovery showing where the new Zappa chargeability anomaly was identified in a 2022 IP survey. Detailed geological mapping revealed a highly altered quartz-sericite-pyrite (QSP) zone in Stuhini volcanic and sedimentary rocks measuring 200 m by 500 m with intense texture destruction of host protolith. Stockwork quartz-sulphide veinlets were abundant and massive pyrite veins measuring several cm across were common. The alteration zone extends to the east with strong alteration mapped directly adjacent to the receding glacier. The team was surprised to see tens of meters of newly exposed altered rock compared to historic mapping completed 2 years ago.

An expanded geophysical Induced polarization (IP) survey was completed to the east of the 2022 survey that included 4 individual lines totaling 6 line-km with a depth of investigation down to 500 m (see map below). A walking magnetic survey was also completed along the IP lines, and initial pseudo sections have been highly encouraging. This information will be critical in outlining the true size of the Zappa chargeability anomaly and is being used to pinpoint the center of this alteration system that is planned to be drill-tested in 2025. The team is excited to review and process the data and it will be released once interpretation is complete.

A total of 50 Terraspec samples were taken and results demonstrated high wavelengths for AlOH bonds with moderate zonation towards the centre of the Zappa surface alteration. This confirms high temperature clays are associated with alteration above the chargeability anomaly and adds to the confidence the team has in this target. Detailed interpretation is ongoing.

Map of Discovery / Zappa chargeability Anomaly, 2024 IP lines pending

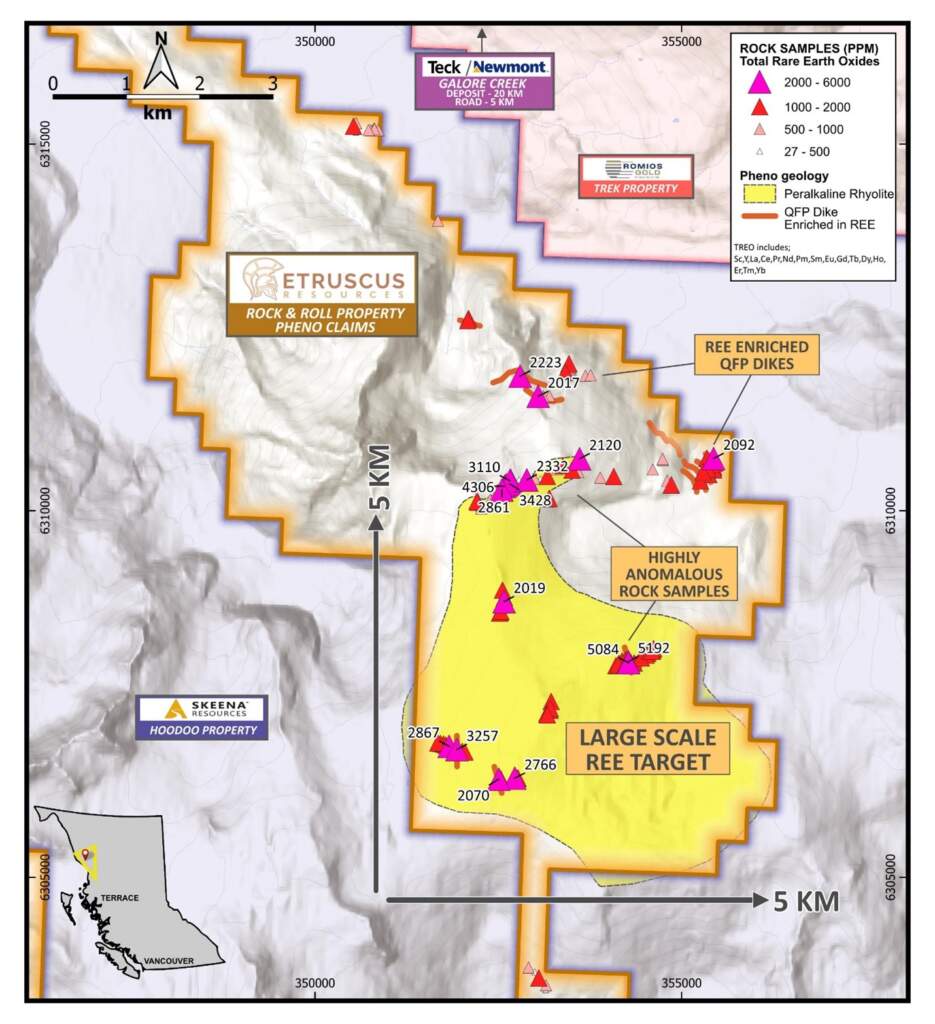

Pheno REE’s

The inaugural exploration program on the adjoining Pheno claims was successful in identifying a unique critical metal deposit with highly enriched REE values spread across a very large area. A total of 167 rock samples including several different rock types were collected for borate lithium fusion analysis across the large, underexplored land package. Results demonstrated a strong enrichment of rare earth elements at the upper elevations of the property predominantly hosted in the rhyolites that are spread across an area of more than 5 km. These rocks appear to be highly evolved peralkaline rhyolites that form as the last gasp of felsic lavas in a volcanic chamber. A baseline of 1,000 ppm TREO* was selected as indication of strong REE enrichment as this number has been used at other bulk tonnage REE deposits as a cut-off grade capable of delivering economic returns. Of all the rocks taken across the claims, 76 rocks or 45% of the samples returned >1,000 ppm TREO. These results are highly encouraging and suggest the possibility of a very large mineralized REE system capable of containing significant REE reserves exists on the property.

*TREO (Total Rare Earth Oxide) is defined as the summation of the Rare Earth Oxides of Cerium through Lutetium on the periodic table, plus Scandium, Yttrium and Lanthanum.

Property Exploration

Further field work was completed on the Heather and the Kashmir showing as a pipeline of targets continues to progress. At the Heather target where high-grade gold samples and a 300 m Au-Cu-Ag soil anomaly have previously been discovered, the team has identified the source of the chargeability anomaly outlined during the 2022 IP survey. Multiple plagioclase porphyritic intrusion measuring 5 m – 50 m in diameter were shown to contain 0.5 to 2% disseminated pyrite. This unit does not provide an immediate target but advances the teams understanding of the system. A mineralized piece of float containing abundant galena was sampled and returned 40.1 g/t Au.

Further work was completed at the Kashmir showing, a Mo-Cu porphyritic intrusion, to identify extension or high high-grade pockets of mineralization. Follow up on a highly mineralized sample from 2022 identified a second, similar mineralized boulder that returned 23.8 g/t Au, although identification of the source was unsuccessful. Mapping took place to outline a 100 m wide monzonitic intrusion with 1-10 cm wide quartz molybdenum veins. This porphyry target remains a high priority although the steep nature of the showing provides difficult access for completion of a geophysical survey, the team is exploring options on how to advance this target.

Financing

The Company also reports the closing of its previously announced financing (See News Release September 11, 2024), subject to final regulatory approval. The Company raised a further $10,000 through issuing 100,000 non-flow-through units at $0.10 per unit. A finder’s fee of $800 was paid and 8,000 share-purchase warrants were issued, exercisable at $0.15 per share for 2 years. In total, the financing raised $402,000 through the issuance of 2,440,000 flow-through units at $0.125 per unit and 970,000 units at $0.10 per unit and paid total finders’ fees of $1,600 and issued 16,000 finder’s warrants exercisable at $0.15 per share for 2 years.

Each non-flow-through unit consists of one common share and one-half (1/2) of a non-transferable share purchase warrant with each whole warrant exercisable into one additional common share at a price of $0.15 per share for a 2-year period.

Each flow-through unit consists of one flow-through common share and one-half (1/2) of one non-flow-through, non-transferable share purchase warrant with each whole warrant exercisable into one additional common share at a price of $0.18 per share for a 2-year period.

All shares issued under the private placement are subject to a hold period of four months and one day from the date of issuance.

The flow-through shares will qualify as “flow-through shares” for the purposes of the Income Tax Act (Canada) (the “Act”). The proceeds of the flow-through private placement will be used to incur “Canadian exploration expense” (within the meaning of the Act). The Company will renounce these expenses to the purchasers with an effective date of no later than December 31, 2024, and as required under the Act, and, if applicable, as required under Provisional legislation.

QP Statement

Technical aspects of this news release have been reviewed and approved by Stephen Wetherup, BSc., P.Geo., who is a Qualified Person as defined under National Instrument 43-101.

QAQC Statement

The Company has adopted a rigorous quality assurance and quality control (“QA/QC”) program to ensure best practices in sampling of all rock, soil and silt material. The Company’s samples are being assayed by ALS Geochemistry Labs which has facilities in Terrace and North Vancouver BC. and is independent of the Company. All rock samples were crushed to 70% pass 2mm fraction, and then a 250g split was pulverized to better than 85% passed a 75-micron screen. Multi element analysis for gold copper exploration was performed by by ALS Laboratory using aqua-regia digestion ICP-MS package (ME-MS41). Elevated gold grades (>1 g/t) were analyzed by fire assay and ICP-AES (Au-ICP21). Samples that returned above detection limits in silver, copper, lead and zinc were reanalyzed with appropriate ore grade analysis to determine absolute values. For rare earth elements samples, a lithium borate fusion analysis was performed using ALS package ME-MS81 for full digestion of REE minerals.

ALS Labs is an independent provider of geochemical laboratory services for the exploration and mining industries and is an ISO 17025 (Testing and Calibration) and ISO 9001 (Quality Management System) accredited laboratory.

About Etruscus

Etruscus Resources Corp. is a Vancouver-based exploration company focused on the acquisition and development of precious metal mineral properties. The Company’s flagship asset is the 100%-owned Rock & Roll Property comprising 29,344 ha near the past producing Snip mine in Northwest B.C.’s prolific Golden Triangle.

Etruscus is traded under the symbol “ETR” on the Canadian Securities Exchange, “ETRUF” on the OTC and “ERR” on the Frankfurt Stock Exchange. Etruscus has 53,370,361 common shares issued and outstanding.

|

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Press Release may contain statements which constitute ‘forward-looking’ statements, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities and operating performance of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities or performance and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements as a result of various factors. Such risks, uncertainties and factors are described in the periodic filings with the Canadian securities regulatory authorities, including quarterly and annual Management’s Discussion and Analysis, which may be viewed on SEDAR at www.sedar.com. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as intended, planned, anticipated, believed, estimated or expected. The Company does not intend, and does not assume any obligation, to update these forward-looking statements.

Neither the CSE Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.